The Convenience Premium: How Gen Z vs Millennials Value Speed Over Savings

In today’s hyper-accelerated digital landscape, the concept of convenience has evolved from a nice-to-have to a fundamental expectation. As e-commerce platforms compete on delivery speeds, checkout simplicity, and instant gratification, understanding how different generations value convenience over cost savings becomes crucial for strategic positioning.

The data reveals fascinating insights into how Gen Z and Millennials approach the convenience premium, and the implications for e-commerce marketers are significant.

Let’s dive in.

Millennials

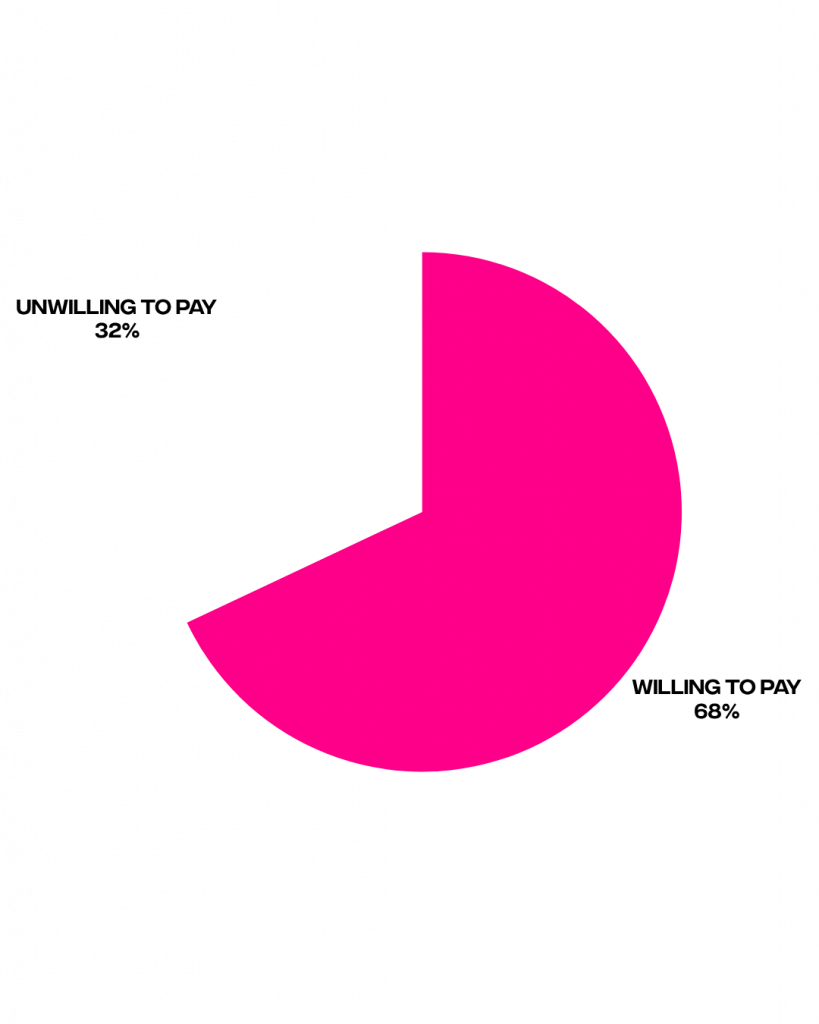

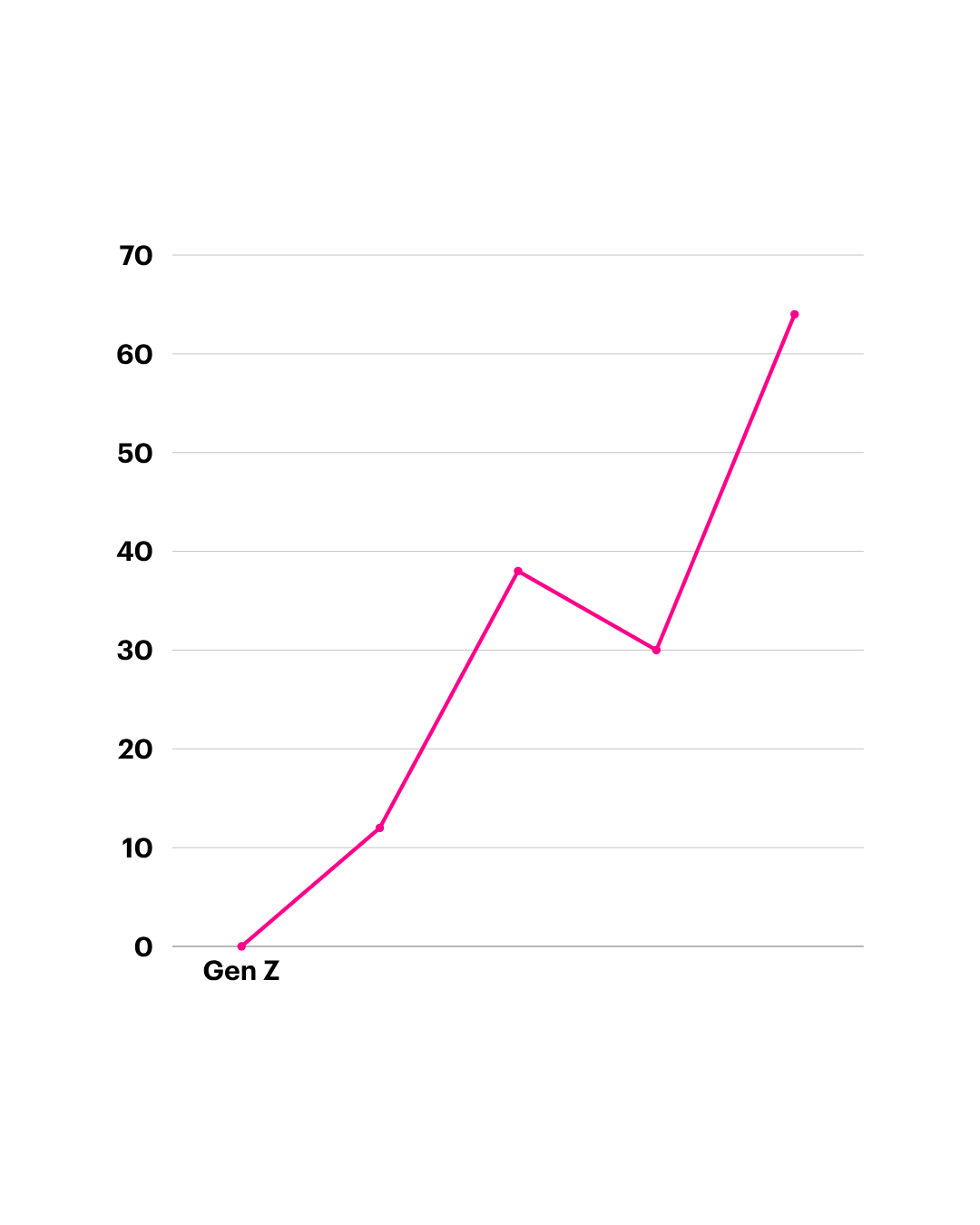

Having lived through the transition from dial-up to instant everything, Millennials have developed a sophisticated relationship with convenience. 68% of Millennials report being willing to pay extra for faster delivery, compared to 61% of Gen Z. This 7% difference suggests that Millennials, now in their peak earning years, increasingly view time as their most valuable commodity.

More revealing is their approach to checkout friction. 73% of Millennials abandon carts due to lengthy checkout processes, while 67% of Gen Z do the same. This indicates that Millennials have less patience for complicated purchase flows, likely reflecting their busier lifestyles juggling careers, mortgages, and family responsibilities.

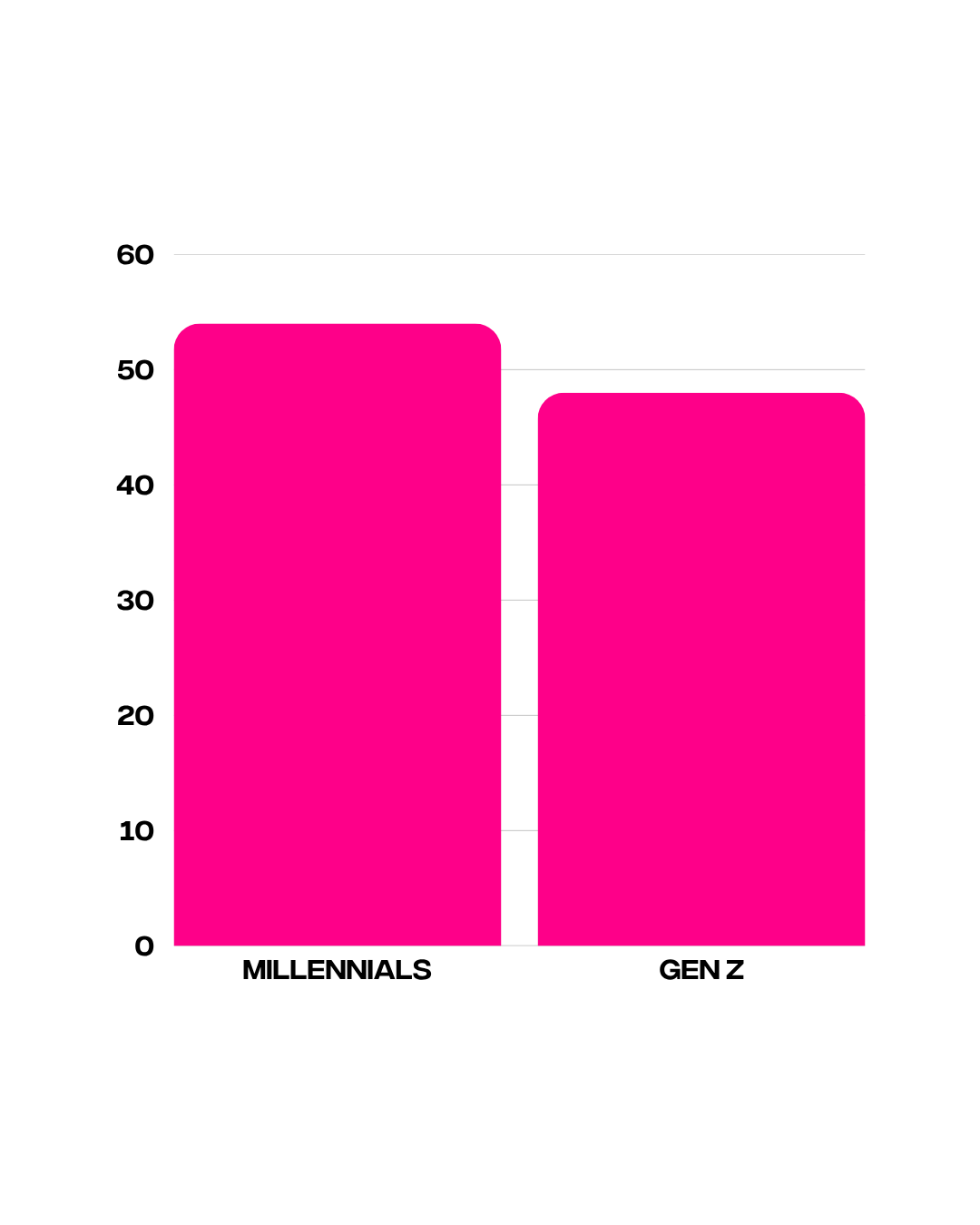

The convenience premium extends beyond delivery speed. 54% of Millennials use subscription services to avoid repeat purchasing decisions, compared to 48% of Gen Z. This “set-it-and-forget-it” mentality demonstrates how Millennials are willing to pay for predictability and reduced decision fatigue.

Perhaps most tellingly, 41% of Millennials report choosing familiar platforms over cheaper alternatives specifically for convenience, suggesting they’ve moved beyond pure price optimisation toward time and effort efficiency. For e-commerce marketers, this points to a demographic that responds well to streamlined experiences, premium service tiers, and loyalty programs that reduce friction.

Gen Z

Despite their reputation for instant gratification, Gen Z’s relationship with convenience is more complex. While 61% are willing to pay for faster delivery, their digital nativity means they’re also more adept at finding workarounds and alternatives.

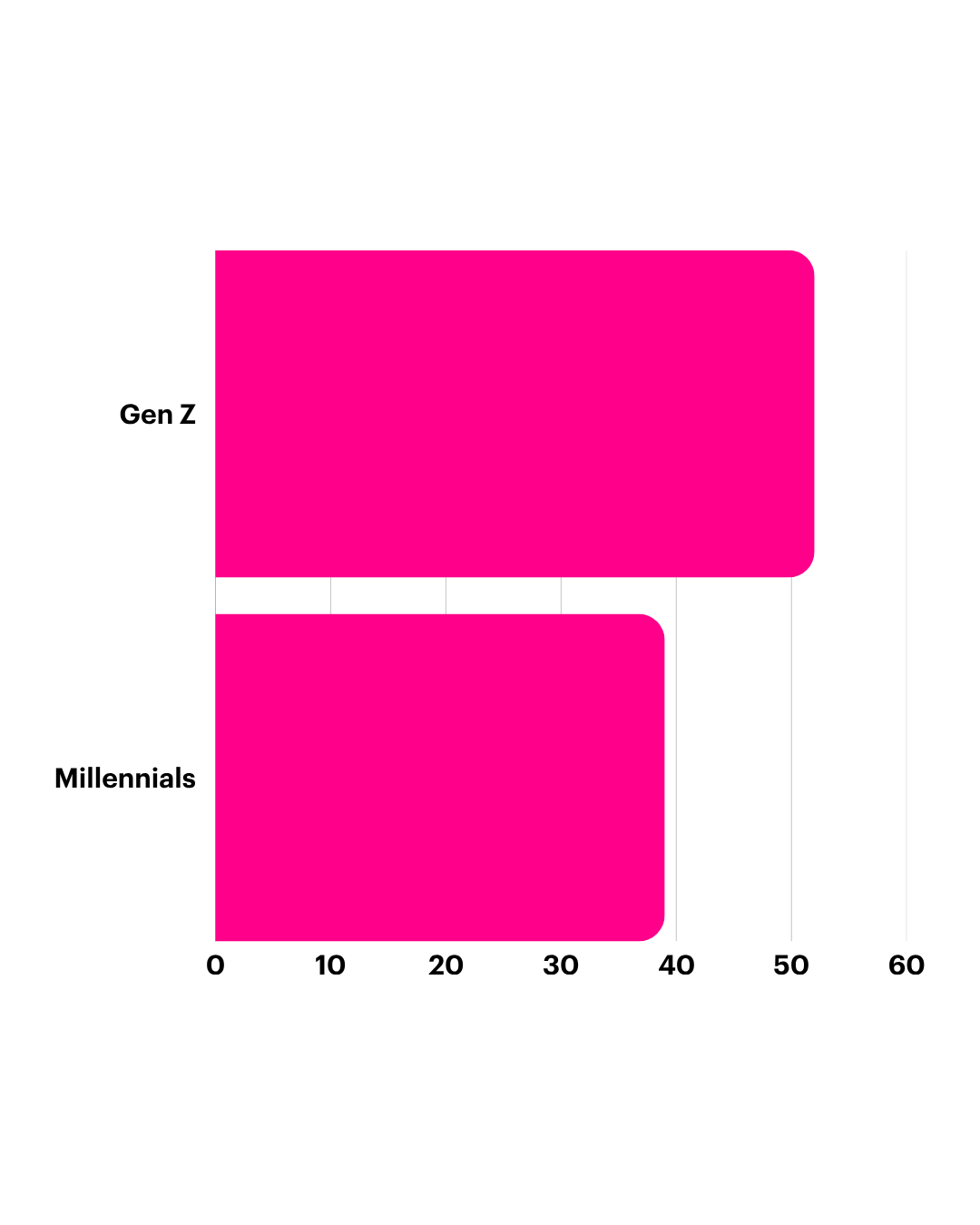

52% of Gen Z actively use price comparison tools before paying convenience prices, compared to 39% of Millennials. This suggests that while Gen Z values speed, they’re more strategic about when and where they’ll pay extra for it. Their comfort with multiple apps and platforms means they can quickly assess whether a convenience premium is worth it.

Interestingly, Gen Z is 23% more likely to use buy-now-pay-later services – think Klarna’s demographic – when paying convenience premiums, indicating they want immediate gratification but prefer to defer the financial impact. This behavioural pattern suggests they’re willing to pay for convenience, but on their own terms.

This generation also shows distinct preferences around convenience types. 64% of Gen Z prioritise mobile-optimised experiences over desktop, and they’re 31% more likely to abandon purchases on non-mobile-friendly sites if the process is becoming lengthy and inconvenient. For them, convenience isn’t just about speed–it’s about platform compatibility and seamless mobile experiences. This digital native generation knows what they want and how they want it.

The Strategic Implications

For Millennials, investing in premium service options, express delivery, and streamlined repeat purchase experiences can justify higher price points and improve retention.

For Gen Z, the focus should be on mobile-first experiences, flexible payment options, and transparent value propositions around convenience fees. They’re willing to pay premiums, but they want to understand exactly what they’re getting and have control over the transaction terms.

Both generations show convergence on one key point: 78% will pay more to avoid frustrating experiences.

The convenience premium conversation ultimately reveals that today’s consumers are increasingly willing to pay for their time and peace of mind. E-commerce marketers who can effectively communicate the value of convenience, while tailoring the experience to generational preferences will be best positioned to capture this growing market segment.

The question isn’t whether consumers will pay convenience premiums–it’s whether brands can deliver experiences that justify them.

Our influencer marketing agency and social agency are located worldwide, with our agency network based in the USA, UK, UAE, and China.

If you want to find industry insights, visit our influencer marketing and social media blogs.

@sociallypowerful

We'll show you how to start powerful conversation, drive social engagement, build your brand, hit sales targets or meet other goals you have, wherever you are in the world.

Work with us