The Vogue Business Beauty Index 2024: What Brands Have Made the Cut?

Jul 15, 2024

Industry Trends

In 2023, the first Vogue Business Beauty Index was released, much to the delight of consumers and marketers alike.

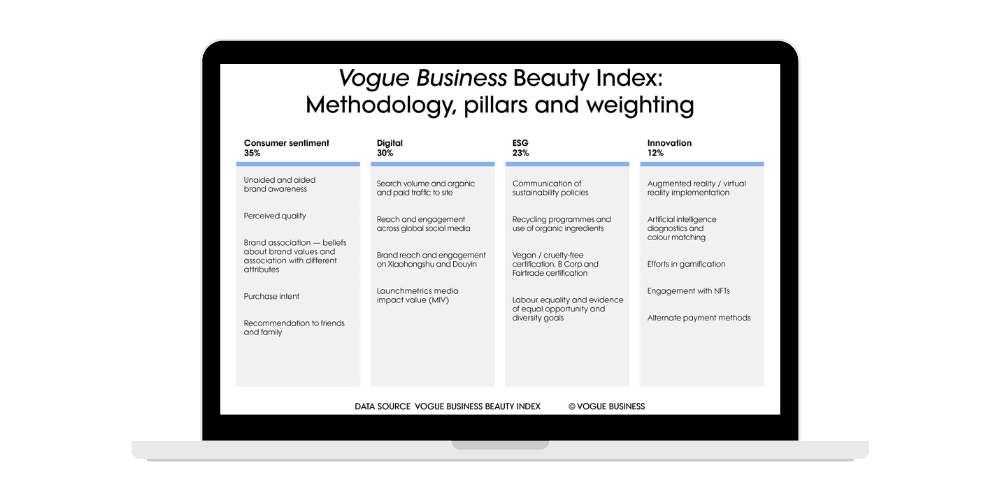

The index takes a fine tooth comb to popular beauty brands, rating them on consumer sentiment, digital, ESG and innovation.

Vogue Business observes thirty brands in its index, from well-established industry leaders to up-and-coming indie brands. The index leans heavily on consumer sentiment, using results from an annual beauty consumer sentiment survey to power its findings.

Coming in at a total of 12, data heavy pages, we have pulled together the biggest findings from the report; so you can sit back and enjoy, without all the heavy lifting.

THE VOGUE BUSINESS BEAUTY INDEX 2024

The Vogue Business Beauty Index seeks to provide a complex assessment of the factors spurring growth and success in the current beauty industry. Using data from over 3,000 beauty consumers from Vogue and GQ readers in six different markets, in combination with third-party social data, performance audits, and brand questionnaires, the Index ranks thirty industry-defining beauty brands.

Read on for the top findings.

The top five brands

The Ordinary, The Estée Lauder Companies

@theordinary psa.. u can use this serum with literally everything 💯 #theordinary #balancingandclarifyingserum #blemishes

Coming in at number one is The Ordinary.

Winner of 2023’s Vogue Business Beauty Index, The Ordinary has maintained its industry domination over the past year. The brand continues to showcase exemplary scores across both consumer and ESG categories, and is the most highly rated brand for innovation, likelihood to recommend, perceived quality, and purchase intent.

The Ordinary’s ESG prowess is powered by its commitment to environmental sustainability, as reflected in consumer beliefs on its environmental efforts.

La Roche-Posay, L’Oréal Group

@larocheposay The best tips for acne-prone skin come from @Dounia 🫶 Of course we listen carefully! #larocheposay #trend #acneprone #skin #skincare #skintok

Increasing by four ranks this year, La Roche Posay is a rising star.

La Roche Posay’s rank increase is largely due to its outstanding improvements in digital performance and consumer perception. Its Black Friday virtual skin consultations greatly contributed to this.

On top of this, the brand is owner of the most-viewed piece of content for the Index’s review period; its US Open YouTube campaign.

Cerave, L’Oréal Group

@cerave Operas are dramatic. Cleansing doesn’t have to be. Coming soon to a sink near you 👀 CeraVe CleanseLikeADerm DevelopedWithDermatologists

Improving by a whopping five ranks for the 2024 Vogue Business Beauty Index, is Cerave.

Cerave made waves in 2024 with its outstanding digital marketing, which led to the brand gaining leagues in consumer appreciation and awareness. The brand has honed in on its science-backed product development, allowing it to flex its price from competitive to premium.

The brand’s influencer strategy has been immensely successful, particularly its now famous Michael Cera Superbowl campaign. Thus securing it a champion place in the digital pillar.

Charlotte Tilbury, Puig

@charlottetilbury @@Dr Ewoma 👋🏾’s HOLY GRAIL 🏆 Charlotte’s iconic #MagicCream 😍 #CharlotteTilbury

Whilst its position slipped two places from 2023 Vogue Business Beauty Index, Charlotte Tilbury continues to be an industry leader.

The beauty brand’s digital performance was of particular note in 2023, with its surprisingly successful Formula One sponsorship and entry into the metaverse. These out-of-the box campaigns excited consumers and expanded the brand’s reach even further.

Charlotte Tilbury’s ESG continues to be industry defining, being the only beauty brand offering product refills to its consumers.

Kiehl’s, L’Oréal Group

https://www.tiktok.com/@kiehls/video/7387108837506977054?is_from_webapp=1&sender_device=pc&web_id=7374011931126318624

Decreasing by two places, is Kiehl’s.

Kiehl’s has consistently spearheaded the now incredibly successful bespoke wellness space. Its now non-existent Apothecary skincare service was industry defining, but its closure emphasises the challenges brands face in scaling these kinds of ventures.

However, the brand continues to rank highly with consumers when it comes to personalisation, with consumers rating Kiehl’s second for products they can personalise to their individual needs.

Key Insights

In terms of key insights, the Vogue Business Beauty Index reveals incredibly interesting information about consumer desires.

The report found that 65% of beauty consumers are excited about augmented reality try-ons in the beauty industry. 35-44 year olds are especially keen on this space.

In terms of consumer sentiment, 68% of consumers claimed that they will continue to purchase the same or more pricey products in 2025. Interestingly, French consumers were the most ready to increase their purchase amounts, with 73% saying they were willing to spend the same or more in the upcoming year.

On the digital front, seven celebrity-backed brands drove $191 million in media impact value over on Instagram, in comparison to $58 million on TikTok. In comparison, non-celebrity brands drove $72 million on Instagram and $30 million on TikTok. This emphasises the success of celebrity and influencer marketing on social media.

Finally, in terms of ESG, 13% of brands committed to a complete phase-out of virgin plastics in products. This is substantially below the mark of 65% of consumers who claim that waste reduction and ethical sourcing contribute to their purchasing decisions. As such, moving into 2025, there is a substantial space for brands to launch into on this front.

New features and rank changings

The Vogue Business Beauty Index featured three new beauty brands this year.

Clarins, Clinique and Rhode all made their first entry this year, coming in at 9th, 11th, and 29th place respectively. Given that this is Rhode’s second year on the market, it is amazing to see how much of a splash the brand has already made both on the industry and consumers.

@rhode @ana + the mauve duo: sleepy girl + salty tan 👙

Interestingly, out of the 30 brands featured only six improved their standing from last year. Cerave, Drunk Elephant, Elf Cosmetics, La Roche-Posay, Milk Makeup and Tarte were the only brands that increased their rankings from 2023.

CONCLUSIONS

Ultimately, this year’s Vogue Business Beauty Index revealed much about the beauty industry.

Consumers proved that they are excited about the potential for AR in the beauty space. Brands with the capacity to experiment with AR try-ons should capitalise on this excitement, particularly if their target audience is between the ages of 35 to 44.

Moreover, celebrity and influencer driven campaigns continue to ring in the highest media impact value, with Instagram leading the charge ahead of TikTok. As such, brands should focus on influencer and celebrity engagements on Instagram in the coming year.

From a financial standpoint, consumers are set on maintaining or increasing their purchases in the upcoming year. As such, brands should not lean too heavily on attempting price reductions, but rather put their efforts elsewhere.

One such area that brands should focus on is sustainability. Consumers have a high desire for beauty brands to feature waste reduction and ethical sourcing in their business models, but the majority of the industry has not made this a major focus for 2025.

All in all, 2025 is sure to be an exciting year for the beauty industry, filled with innovation, the rise of social-first brands such as Rhode, and plenty of AR focused engagements.

Our influencer marketing agency and social agency are located worldwide, with our agency network based in the USA, UK, UAE and China.

If you want to find industry insights, visit our influencer marketing and social media blogs.

@sociallypowerful

Social And Influencer Marketing News + Insights

Get in touch

We'll show you how to start powerful conversation, drive social engagement, build your brand, hit sales targets or meet other goals you have, wherever you are in the world.

Work with us